via

Instapundit we find this article at

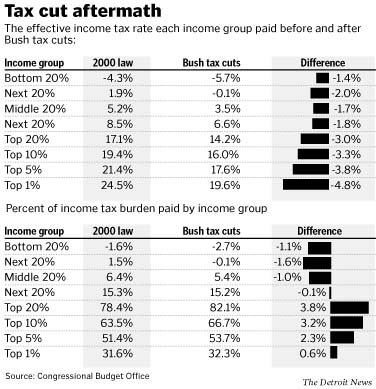

The Detroit News with a nifty little graphic:

Across 109.4 million tax-paying households — from the wealthiest 1 percent with incomes averaging over $1 million to the lowest-earning 20 percent of people with incomes averaging $14,900 — the report shows that all income classes have seen their income tax rates lowered thanks to Bush’s cuts in 2001, 2002 and 2003.

The CBO [nonpartisan Congressional Budget Office] report shows how 2004 income tax rates have dropped for everyone compared with tax laws in force in 2000.

The report also shows that Bush’s tax cuts have been “progressive” — that is, they have shifted the share of the overall federal income tax burden toward the wealthy and away from lower-income earners. Without the Bush tax cuts, the highest-earning 20 percent of households this year would have paid 78.4 percent of all federal income taxes. Now, after the Bush tax cutes, their share of the burden has risen to 82.1 percent. Every other group now pays a smaller share of the total income tax burden.

Next time you hear John Kerry spouting off about Bush's tax cuts taking from the middle class, just remember this little graphic and know that he's full of it.

Read the article above, it's got a lot more information than my little quote.